- Dissecting the Markets

- Posts

- Why I'm buying the dip on Booz Allen Hamilton (BAH)

Why I'm buying the dip on Booz Allen Hamilton (BAH)

It's probably the only defense tech company that isn't rallying alongside Lockheed Martin and other defense stocks.

I was scrolling through X on Friday when I saw a chart from a data-driven trader/investor named @OnlyMajorMoves_ who posted a chart on how the consulting firm Booz Allen Hamilton looks to have bottomed.

Is the low in on $BAH? 🤔

— OnlyMajorMoves (@OnlyMajorMoves_)

8:31 PM • Oct 3, 2025

The Business

For those who don’t know about Booz Allen Hamilton $BAH ( ▲ 1.94% ) , they’re an advanced technology company that delivers solutions for critical defense, intelligence, civil government, and national security missions. Founded in 1914, $BAH ( ▲ 1.94% ) has evolved into a technology-focused firm that builds AI, cybersecurity, and other cutting-edge technology solutions to advance and protect the US.

Their main technology areas include:

Artificial Intelligence: One of the largest AI providers to the federal government

Cybersecurity: Operating one of the most impactful cyber businesses globally

Digital Transformation: Modernizing legacy systems with cloud infrastructure

Space: Delivering intelligence, surveillance, and reconnaissance capabilities

Quantum Technologies: Leading position in quantum computing, sensing, and cryptography

The company serves a diverse federal government client base, including:

Defense (49% of revenue): All six U.S. military branches, Office of the Secretary of Defense, NASA, and Joint Staff

Intelligence (16% of revenue): The 18 organizations of the U.S. Intelligence Community

Civil Government (35% of revenue): Major departments like Veterans Affairs (their largest single customer at 13% of revenue), Health and Human Services, Treasury, Homeland Security, and others

Commercial clients (2% of revenue): Companies in financial services, health, energy, and technology sectors

Overall, Booz Allen operates as a single profit center with 35,800 employees (72% holding security clearances), delivering 95% of their work as prime contractor across 5,279 contracts and task orders.

The Bear Market

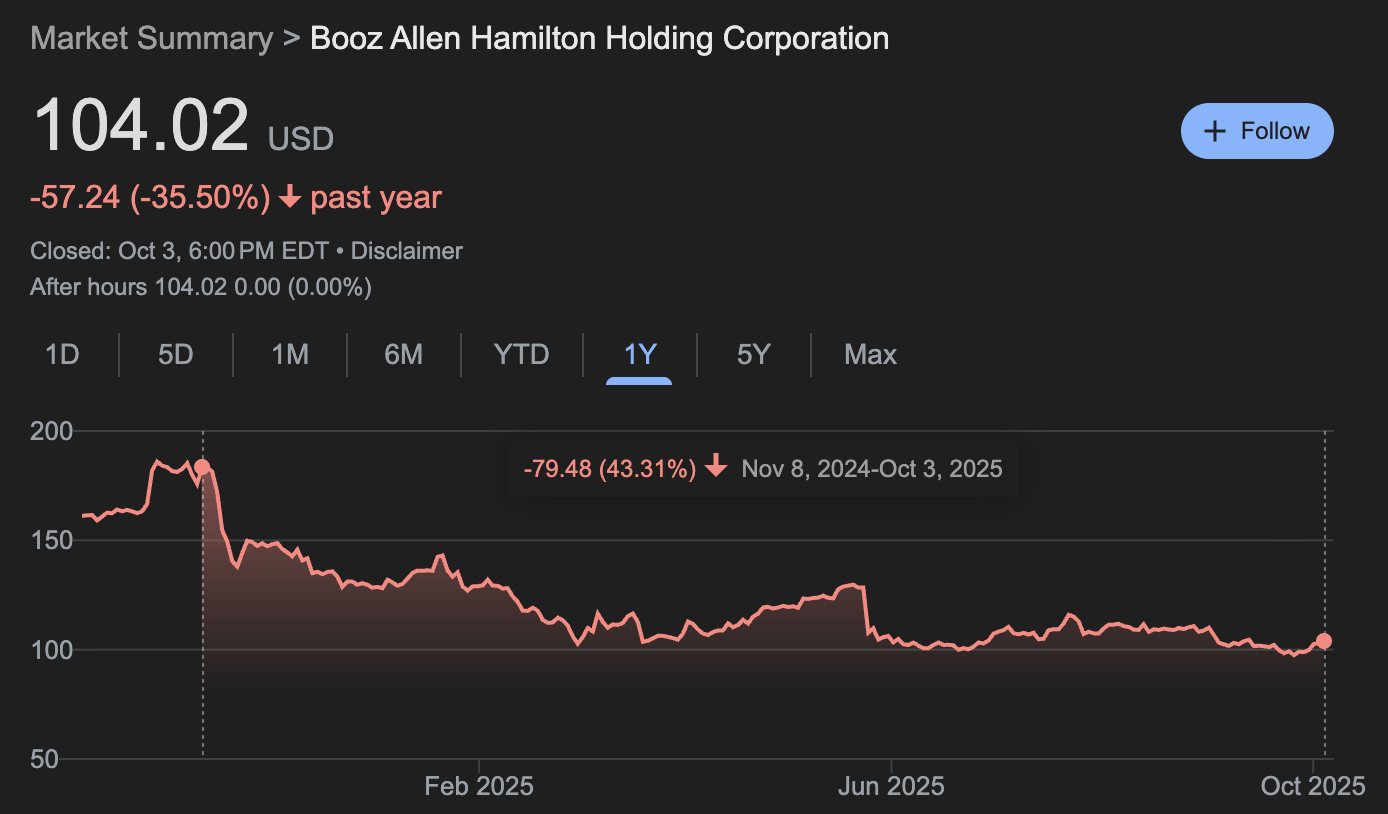

During Trump’s election campaign, one of the big things he promoted was a cut to government spending with Elon Musk creating a department called DOGE (Department of Government Efficiency), which has the sole task of reviewing federal contracts and cutting programs that are wasteful or fraudulent. Since Trump won the election on November 8, Booz Allen’s stock has plunged 43% since then.

BAH’s stock peaked on November 8 and plunged 43% since then

Since the majority of the firm’s revenues, 98% of it, come from the US government, it makes sense that investors would steer clear of the stock as DOGE would take effect and start scrutinizing government contracts. The scrutiny on government contracts isn’t new, as anyone who does business with the government will always get their contracts scrutinized by the US Government Accountability Office, internal and external auditors, or even journalists.

Reading their Q1’26 earnings transcript, I was able to glean at the effect that DOGE had on the business. While DOGE wasn’t mentioned in the call or in their 10-Q, management did note that their Civil business declined 13% YoY.

The Civil business works with the Departments of Veterans Affairs, Health and Human Services, Treasury, Labor, Homeland Security, Justice, Energy, Commerce, and Transportation. DOGE has impacted these departments in several ways. Most of it relates to cutting staffing and freezing grants and payments.

In one example, for the Department of Veterans Affairs, DOGE has canceled over 800 contracts that support everything from chemotherapy treatment to records digitization.

Seeing these headlines and knowing that many organizations are losing revenues overnight because of DOGE is why investors were rational to sell their shares.

Furthermore, the CEO, Horacio D. Rozanski, noted in the earnings call that there was “near-term funding continues to move slowly through the procurement environment,” while also noting that the procurement environment is “operating below historical speeds.”

To add, the CFO, Matthew A. Calderone, said on the call that there was “more variability in converting bookings to revenue than we have seen in previous years,” which speaks to the fact that the current administration is scrutinizing whether Booz Allen has met their performance obligations or not for each invoice they receive. If Booz Allen has fulfilled its performance obligation, it can bill for the work it has done under that contract and eventually get paid for it.

Overall, the concerns over the business are valid. The bears were right to be concerned about both Booz Allen’s current contracts, as the government is scrutinizing

The Opportunity

Despite everything, I believe that the concerns for the company are overblown. It’s been nine months into this new administration, and Booz Allen Hamilton has seen its revenues stabilize despite DOGE’s review of all government contracts.

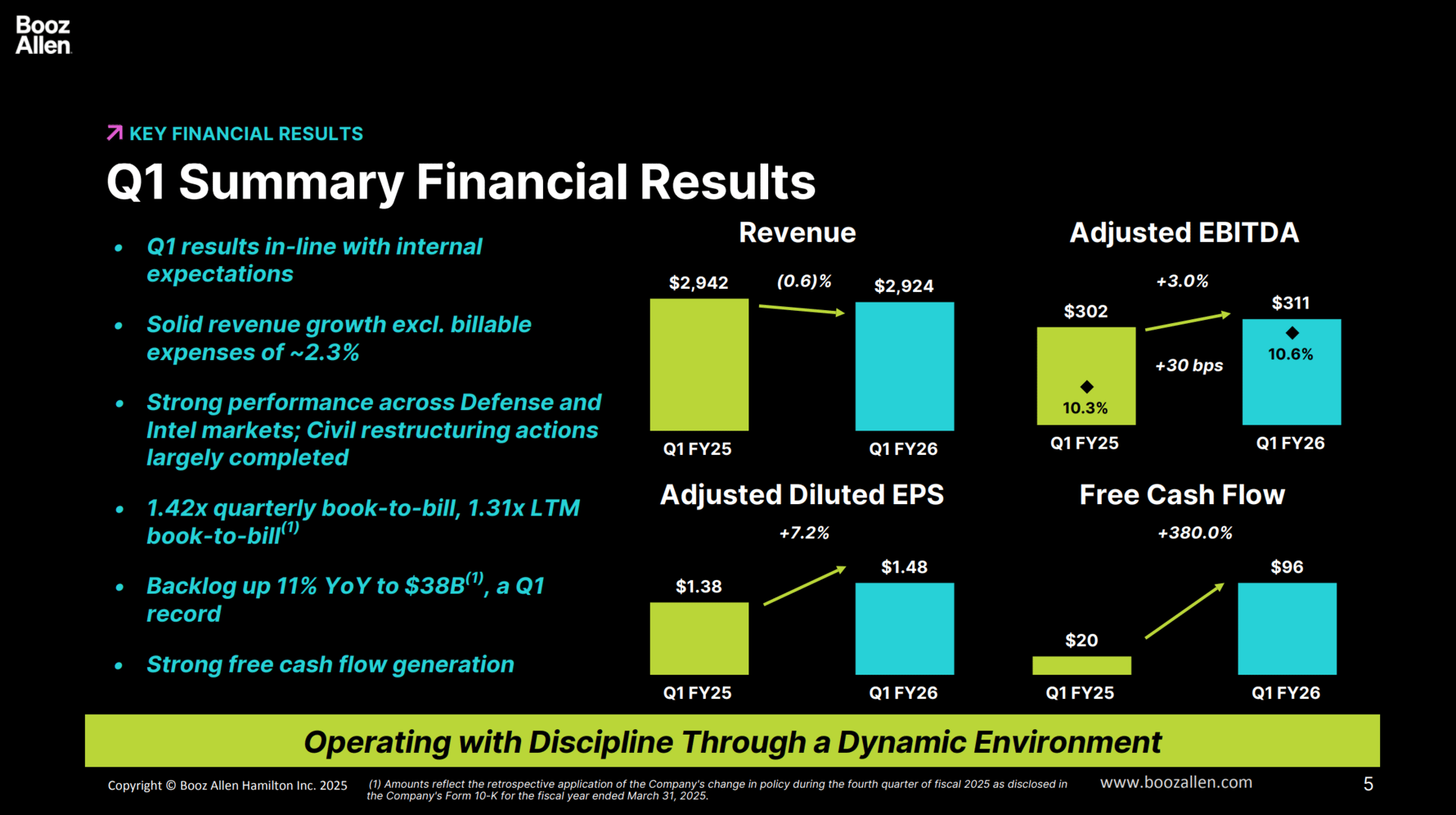

Looking at their Q1’26 earnings results, even if revenues have barely fallen, its free cash has soared and its backlog has grown 11% YoY, which is contrary to what one would expect in an administration that’s scrutinizing and canceling many government contracts.

Reading Booz Allen’s Q1’26 10-Q, I found that their free cash flow has grown 380% YoY for two big reasons:

Booz Allen had a stronger collection performance, which means the government has been better at paying their bills on time (strange considering the fiscal environment for the year)

They had spent less cash in investing activities as they didn’t acquire any companies this year. Last year, Booz Allen acquired PAR Government Systems Corporation (PGSC).

Interestingly, despite concerns that the firm may lose government contracts over DOGE and the administration’s crackdown on government spending, Booz Allen increased their share buybacks for the year to $65 million. I like the confidence that management has in their business, and ramping up share buybacks during a bear market, while the firm is still doing well, will create more value for shareholders in the long run.

In the Q1’26 earnings call, CFO Matthew A. Calderone noted that "the company achieved an excellent quarterly book-to-bill of 1.42x” and its “total backlog hit an all-time Q1 record of $38 billion.” The total backlog is up 11% YoY.

For background, the book-to-bill ratio compares the dollar value of new orders received (bookings) to the dollar value of goods or services delivered and billed (billings) over a specific period, typically a month or quarter. A ratio above 1 indicates strong demand.

These two things are something you don’t normally hear in an environment with DOGE and immense cuts to government spending.

On the tax side, the passing of The One Big Beautiful Bill will give Booz Allen $200 million in cash tax benefits as they can fully expense their research & development expenditures. Plus, management noted that they’ll get a $170 million tax refund from the IRS next year, as it made an agreement with them on an uncertain tax position relating to R&D tax credits, excess tax benefits for employee share-based compensation, and the Foreign Derived Intangible Income deduction.

On the contracts side, during the quarter, Booz Allen got a few major contracts, like:

$315 million Air Force contract for TOC-L Battle Management System (deploying to 70 locations worldwide)

$51 million CBP modernization task order with AWS partnership

Successfully deployed Modular Detachment Kit (MDK) in live fire exercises across Europe and Africa

Tactical Assault Kit tools deployed in theater, hurricane relief, Super Bowl, and presidential inauguration

$25 billion in Golden Dome funding with an additional ~$24 billion for missile defense

At the same time, the CEO even said that the firm’s technology-based approach reasonates loudly with the current administration, as the current administration is looking to invest in AI, quantum computing, and cybersecurity to achieve cost efficiency and military effectiveness. Knowing this, one can be optimistic about Booz Allen’s ability to drive more backlog growth even amid DOGE and other concerns.

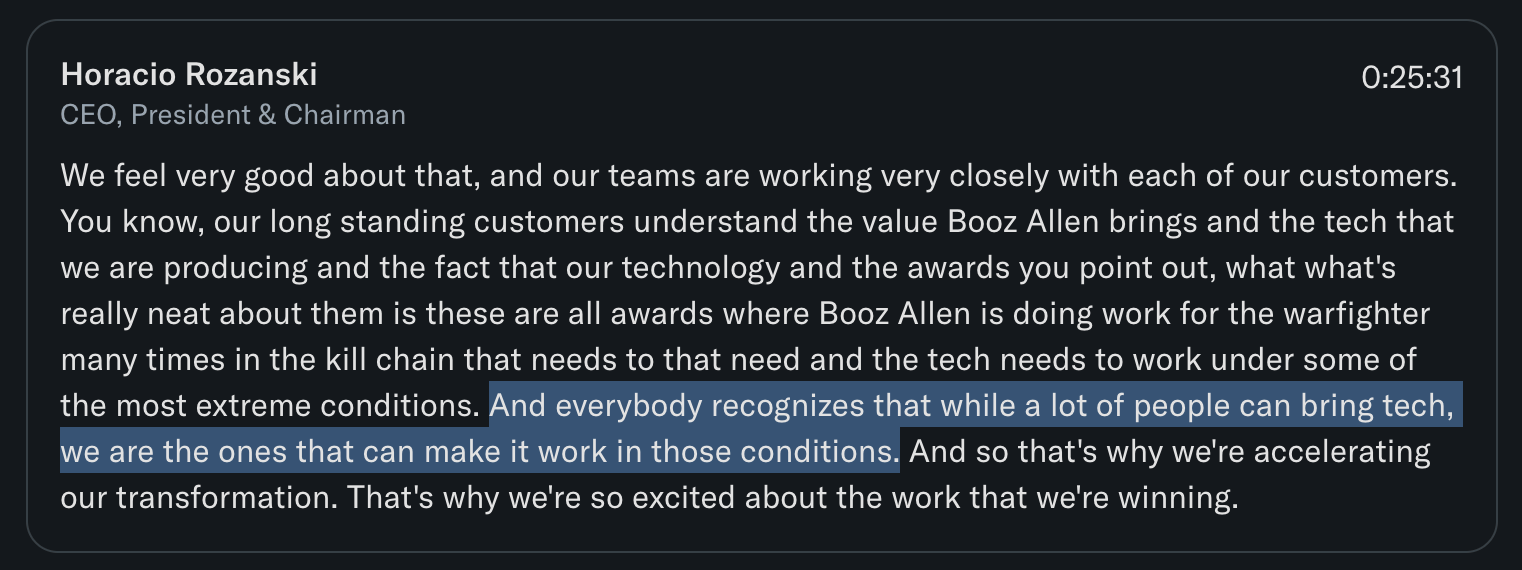

Even with everything I’ve talked about, let’s not forget that the US government is dependent on Booz Allen. As Rozanski said in the earnings call, “…while a lot of people can bring tech, we are the ones that can make it work in those conditions.”

Rozanski’s statement on how Booz Allen is different from other consulting and tech firms.

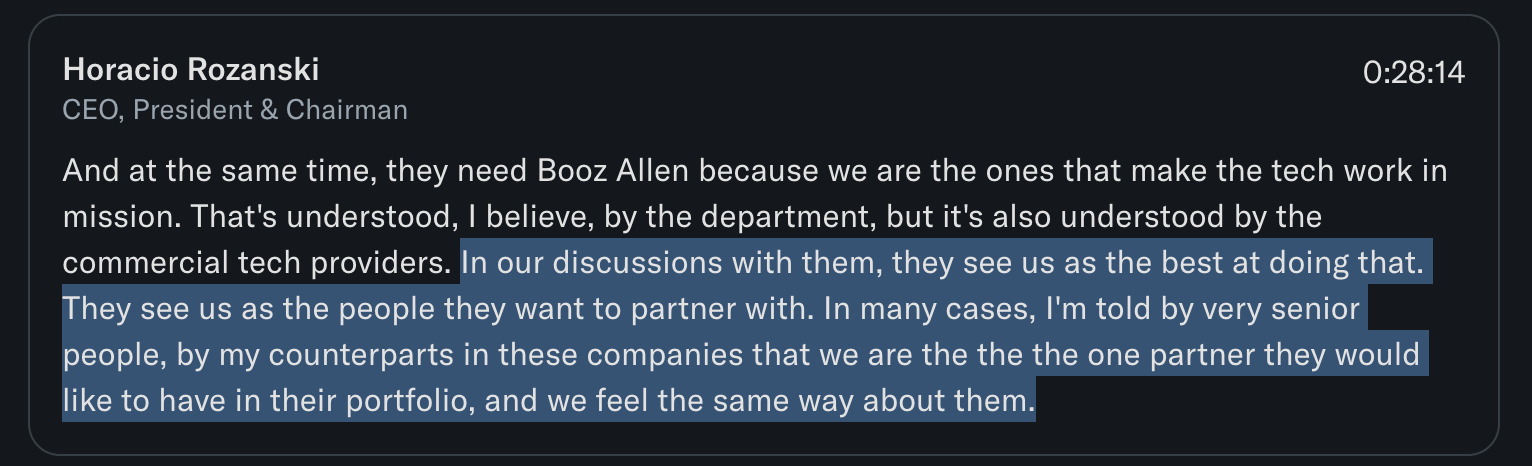

And Rozanski also said this:

Rozanski’s statement on how the US Government sees Booz Allen as the best.

Additionally, Booz Allen has their own venture capital division called Booz Allen Ventures. This division invests in startups that are in the defense tech niche, and Booz Allen works with these startups to co-create technologies that the US government needs. Booz Allen Ventures was founded in 2022 and had $100 million in funding, and earlier this year, they increased the funding capacity of the fund to $300 million.

For projects like the Golden Dome, which are very complicated and Booz Allen can’t do alone, they need the help of other startups to help develop the technologies needed to fulfill their performance obligations. By investing in startups that can help create things like the Golden Dome, Booz Allen can boost the development of those technologies. Funding is one of the big issues that hard tech startups face as they’re developing tech that promises to transform the world.

Conclusion

After everything, it doesn’t surprise me that contrarian investors and bargain hunters will pounce on the opportunity that Booz Allen $BAH ( ▲ 1.94% ) is presenting to them.

What do you think about Booz Allen’s stock? Do you think it’s a great contrarian investment opportunity?