- Dissecting the Markets

- Posts

- The Lululemon Rebound: Why the Dip Creates a Compelling Long-Term Opportunity

The Lululemon Rebound: Why the Dip Creates a Compelling Long-Term Opportunity

How a near 46% stock decline masks the transformation of retail's most loyal customer base into a global lifestyle empire

Don’t forget to read the disclosure at the end of the article.

Walk into any airport lounge, upscale coffee shop, or corporate office today, and you'll witness something remarkable: a sea of consumers wearing the same distinctive athletic wear, moving through their day with the quiet confidence of people who've found their uniform. These aren't athletes heading to the gym—they're executives, parents, students, and professionals who've embraced a lifestyle where the boundaries between workout gear and everyday clothing have completely dissolved.

This cultural shift represents one of the most profound transformations in retail over the past decade, and Lululemon $LULU ( ▲ 2.42% ) sits at its epicenter. While investors obsess over quarterly same-store sales declines and tariff pressures, they're missing the deeper story: Lululemon has achieved something far more valuable than strong financial metrics—it has rewired how millions of people dress, move, and think about their daily lives.

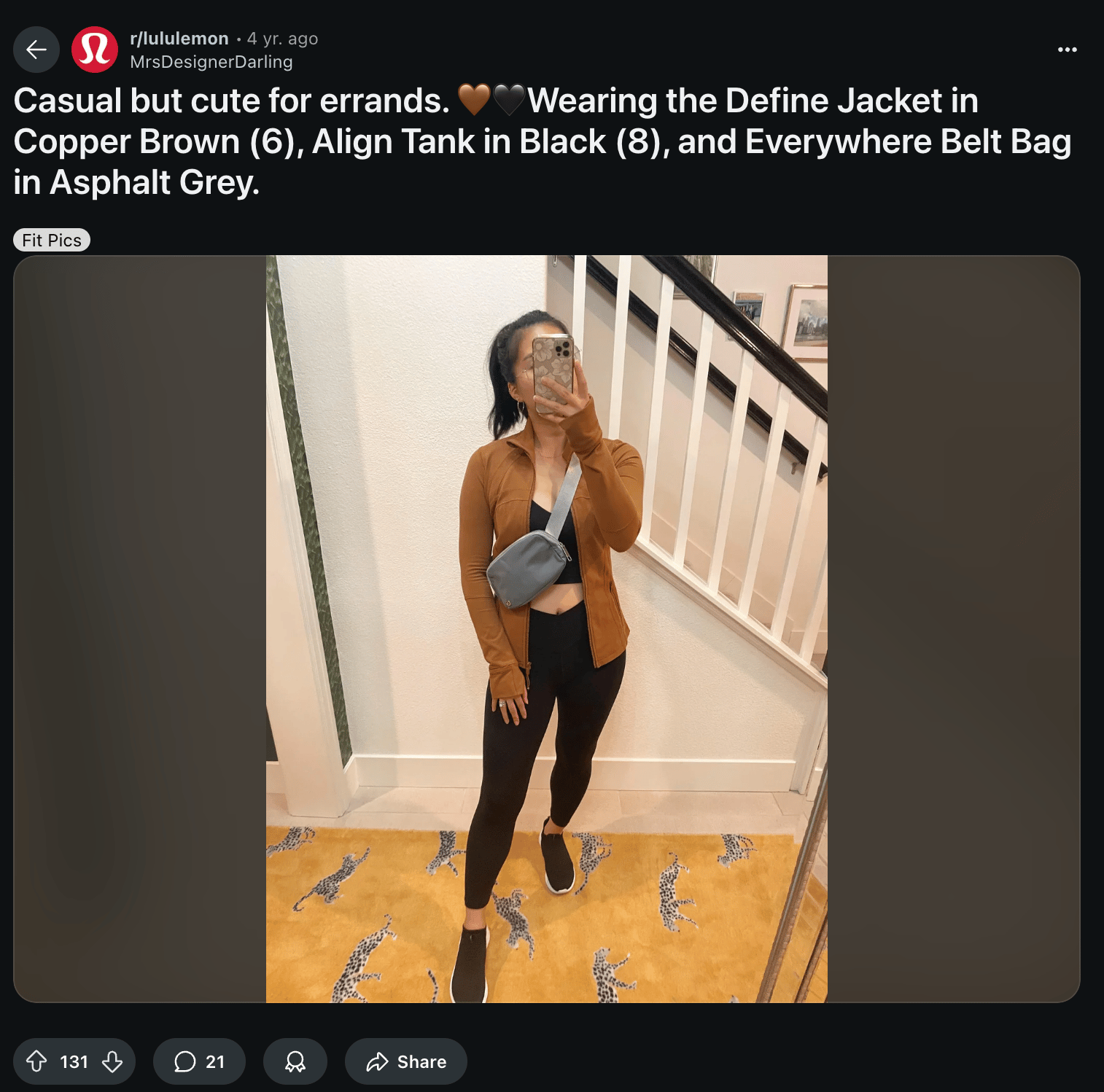

When someone reaches for their Align leggings for a morning yoga session, grabs their Everywhere Belt Bag for errands, or throws on a Define Jacket for a casual meeting, they're not making a simple clothing choice. They're participating in a lifestyle revolution that Lululemon didn't just join—it created. This isn't brand loyalty; it's lifestyle architecture.

The company's recent struggles throughout 2025 mask a more compelling narrative about the future of wellness, athletic participation, and lifestyle consumption. While headlines focus on the 38% stock decline and America’s sales pressures, the underlying trends that originally propelled Lululemon's success are not only intact but accelerating on a global scale.

Why the Street Has Turned Bearish

The company's recent struggles throughout 2025 tell a story that has spooked investors and analysts alike. The stock has plummeted nearly 46% year-to-date, with their Americas sales segment declining in the first quarter of 2025 and growth projections slashed from historical averages of 22% to a modest 6-8% range. The immediate catalysts are clear: Liberation Day tariffs imposing 46% duties on Vietnam (where Lululemon sources 40% of its products) and 32-54% tariffs on other key sourcing countries, combined with what management calls a "cautious consumer" environment.

But the concerns run deeper than macroeconomic headwinds. Jefferies analysts recently conducted field research at Lululemon stores in Westport, Connecticut, and Coral Gables, Florida, uncovering what they view as fundamental strategic missteps. Their scathing analysis identified a brand in crisis, straying from its yoga-inspired roots toward becoming "everything to everybody"—a mass-market retailer like Gap $GAP ( ▲ 1.95% ) rather than a premium lifestyle brand.

The analysts documented concerning trends across three critical areas. First, they found product design choices that seemed designed to alienate core customers: bright primary colors they dubbed the "Sesame Street palette," excessive logos, and an expansion into non-athleisure items like linen shirts and blazers. Second, they discovered operational dysfunction in the form of 7-11 sales racks per store and over 1,000 items on sale online—signs of poor inventory management and weakening demand. Finally, they found basic execution failures, with bestselling Align No Line leggings out of stock in both locations despite being the company's most anticipated product launch.

This analysis echoed criticism from Lululemon's own founder, Chip Wilson, who warned in early 2024 that the company was losing its way by trying to become "everything to everybody." The Jefferies report painted a picture of a brand caught between its premium heritage and mass-market ambitions, succeeding at neither.

Yet this bearish narrative, while capturing real operational challenges, fundamentally misunderstands the deeper forces reshaping both Lululemon's business and the broader consumer landscape. The current struggles mask a more compelling narrative about the future of wellness, athletic participation, and lifestyle consumption that positions the company for a powerful rebound.

The Wellness Economy's Inevitable Expansion

The global wellness economy, valued at over $5.6 trillion, continues to expand as populations worldwide embrace active lifestyles and prioritize health and mental well-being. This isn't a temporary post-pandemic trend—it represents a fundamental shift in how people structure their lives and allocate their spending. From corporate wellness programs to the explosion of boutique fitness studios, from meditation apps to athleisure as everyday wear, the infrastructure supporting this lifestyle revolution continues to grow exponentially.

Lululemon sits at the nexus of this transformation, serving as the premium uniform for a generation that refuses to compartmentalize their active and professional lives. The company's 40% unaided brand awareness in the United States—up from the mid-30s in the fourth quarter of 2024—demonstrates that even during a period of supposed weakness, the brand continues to penetrate consumer consciousness and shape cultural preferences.

International Growth: The Real Story

While analysts fixate on U.S. market challenges, they're overlooking Lululemon's most compelling growth engine. China delivered near 22% revenue growth in the first quarter of 2025, despite a four-point headwind from the Chinese New Year timing. The Rest of World segment grew 17%, reflecting strong momentum across APAC and EMEA regions where Lululemon remains dramatically underpenetrated.

International markets currently represent 43% of Lululemon's business, with management targeting a 50-50 split between domestic and international revenue over time. This geographic diversification provides multiple avenues for growth while reducing dependence on any single market. In China alone, with only 154 stores serving a population of 1.4 billion increasingly health-conscious consumers, the runway for expansion remains vast.

The real-world impact becomes clear when you consider that Lululemon is essentially exporting the North American wellness lifestyle to markets where premium athletic wear was previously limited to traditional sports brands. The company isn't just selling clothing; it's introducing entire communities to yoga, mindful movement, and the integration of fitness into daily life.

The Loyalty Moat: Retail's Most Devoted Customer Base

Lululemon commands one of the most loyal customer bases in all of retail—a competitive advantage that becomes more valuable during challenging periods, not less. This loyalty stems from genuine product innovation and the creation of what customers perceive as irreplaceable items. The company has essentially achieved something most brands can only dream of: transforming customers into evangelists who view their relationship with the brand as part of their identity.

This devotion manifests in measurable ways that separate Lululemon from typical fashion retailers. The company maintains premium pricing power even during promotional periods, with management noting that its markdown rates in the first quarter of 2025 remained below historical levels despite competitive pressures. Customers continue to demonstrate price elasticity different from typical fashion brands, reflecting the technical and lifestyle value they perceive in Lululemon products.

The loyalty extends beyond individual purchases to community engagement that creates emotional connections transcending transactional relationships. Lululemon's grassroots marketing approach—from yoga classes in stores to marathon events—builds the kind of customer relationships that weather economic downturns. The recent Summer of Align campaign, featuring events from Napa Valley to Beijing with 5,000 participants, exemplifies how the brand continues to deepen these community ties even during challenging market conditions.

Product Innovation and the Newness Renaissance

Management's acknowledgment that "newness" was a key factor in recent U.S. struggles actually supports the long-term thesis. The company has systematically addressed this issue, returning newness levels to historical percentages while focusing on innovations that create entirely new product categories rather than incremental seasonal updates.

The success of recent launches—Align No Line leggings selling out despite limited distribution, Daydrift trousers resonating with lifestyle consumers, and Glow Up leggings creating new sensations in the training category—demonstrates that when Lululemon executes its innovation playbook effectively, consumer response remains robust. These aren't minor product extensions; they represent the creation of potential new "core" items that could drive growth for years.

The company's approach to innovation extends beyond individual products to entire activity categories. With significant runway remaining in yoga, running, training, golf, and tennis, Lululemon is positioned to become the definitive brand for consumers who participate in multiple activities—a growing segment as fitness becomes more diverse and integrated into lifestyle routines.

Financial Strength Through Turbulence

Lululemon's financial position provides the foundation for not just surviving current challenges but capitalizing on opportunities that emerge during industry disruption. With $1.3 billion in cash, no debt, and industry-leading operating margins, the company possesses the flexibility to invest aggressively while competitors retrench.

The continued share repurchase program—$430 million in the first quarter of 2025 at an average price of $316 per share—signals management's confidence in long-term value creation. With $1.1 billion remaining in repurchase authorization and current trading levels well below recent peaks, the company is positioned to be opportunistic with capital allocation.

More importantly, the financial strength enables continued investment in growth initiatives during a period when many competitors face capital constraints. Store expansion, supply chain diversification, technology investments, and marketing campaigns can proceed without the compromises forced by leveraged balance sheets or cash flow pressures.

The Tariff Challenge as Competitive Advantage

While tariffs represent a near-term headwind, Lululemon's response demonstrates precisely why the company should emerge stronger from this period. The multi-pronged mitigation strategy—geographic sourcing diversification, vendor negotiations, operational efficiencies, and strategic pricing—reflects the operational sophistication that originally built the business.

Competitors with weaker balance sheets, less diversified supply chains, or inferior customer loyalty will face greater difficulty absorbing tariff impacts. This creates an opportunity for Lululemon to gain market share as competitive dynamics shift in its favor. The company's premium positioning provides pricing elasticity unavailable to value-oriented brands, while its operational scale enables supply chain solutions unavailable to smaller competitors.

Looking back at 2022, when Lululemon hiked prices amid supply chain issues, they continued to have robust same-store sales growth, proving that they can maintain customer loyalty even if they hike prices.

The Athleisure Evolution, Not Decline

Recent concerns about the athleisure market maturity miss the broader evolution occurring within the category. While growth rates may moderate from explosive post-pandemic levels, the fundamental shift toward active lifestyle clothing represents a permanent change in consumer behavior, not a temporary trend.

The key insight is that athleisure is evolving from a discrete category toward the default mode of casual dress. Lululemon's expansion into lifestyle pieces—blazers, trousers, and non-athletic items—positions the company for this evolution rather than being constrained by traditional athletic wear boundaries.

Furthermore, as the athleisure market matures, brand differentiation becomes more important, not less. Consumers increasingly distinguish between generic athletic wear and brands that represent genuine lifestyle alignment. Lululemon's community-building, innovation focus, and premium positioning create sustainable competitive advantages as the market consolidates around fewer, stronger players.

Conclusion: The Invisible Hand of Cultural Influence

My conviction in Lululemon's rebound transcends current financial metrics or quarterly guidance revisions. It stems from the recognition that Lululemon has become integral to how millions of people structure their daily lives and express their values through consumption choices.

When I observe the prevalence of Lululemon products in airports, coffee shops, offices, and fitness studios across multiple continents, I see a brand that has achieved something far more valuable than fashion relevance—it has become the architecture for the active lifestyle economy. The current stock decline creates an opportunity to acquire shares in a company that doesn't just sell products but shapes cultural behavior.

The challenges are real and shouldn't be minimized. U.S. market pressures, competitive dynamics, and macroeconomic uncertainty create legitimate near-term risks. However, these temporary headwinds obscure the durable competitive advantages and global growth opportunities that position Lululemon for long-term value creation.

For investors willing to look beyond quarterly volatility toward the multi-year trajectory of wellness spending, international expansion, and lifestyle evolution, Lululemon's current valuation represents a compelling entry point into one of retail's most distinctive and culturally influential businesses. The dip isn't just an opportunity to buy shares—it's a chance to invest in the continuing transformation of how the world approaches health, fitness, and lifestyle integration.