- Dissecting the Markets

- Posts

- The Bigger Picture with Klarna

The Bigger Picture with Klarna

How Klarna is Dismantling a Debt-Driven Economy and Building a Fairer Future for Finance

What if the financial system we've known for decades—the one built on high-interest credit cards and hidden fees—was fundamentally broken? What if a company emerged not just to patch its flaws but to completely reimagine it? This is the story of Klarna.

Forget the traditional view of finance as a rigid, impersonal system. Klarna's true value isn't found in a ledger; it's found in the seamless, fair, and often delightful experiences it creates for millions of people. This isn't just another fintech company; it's a social and economic movement, poised to revolutionize commerce by placing trust and transparency at its core.

From the Klarna IPO Press Kit

A New Model for a New Era

The old world of commerce is riddled with friction. For consumers, the pain is palpable: surprise interest charges, the anxiety of overspending, and the sheer frustration of a cluttered checkout process. In the U.S. alone, consumers paid an estimated $130 billion in credit card interest and fees in 2022.

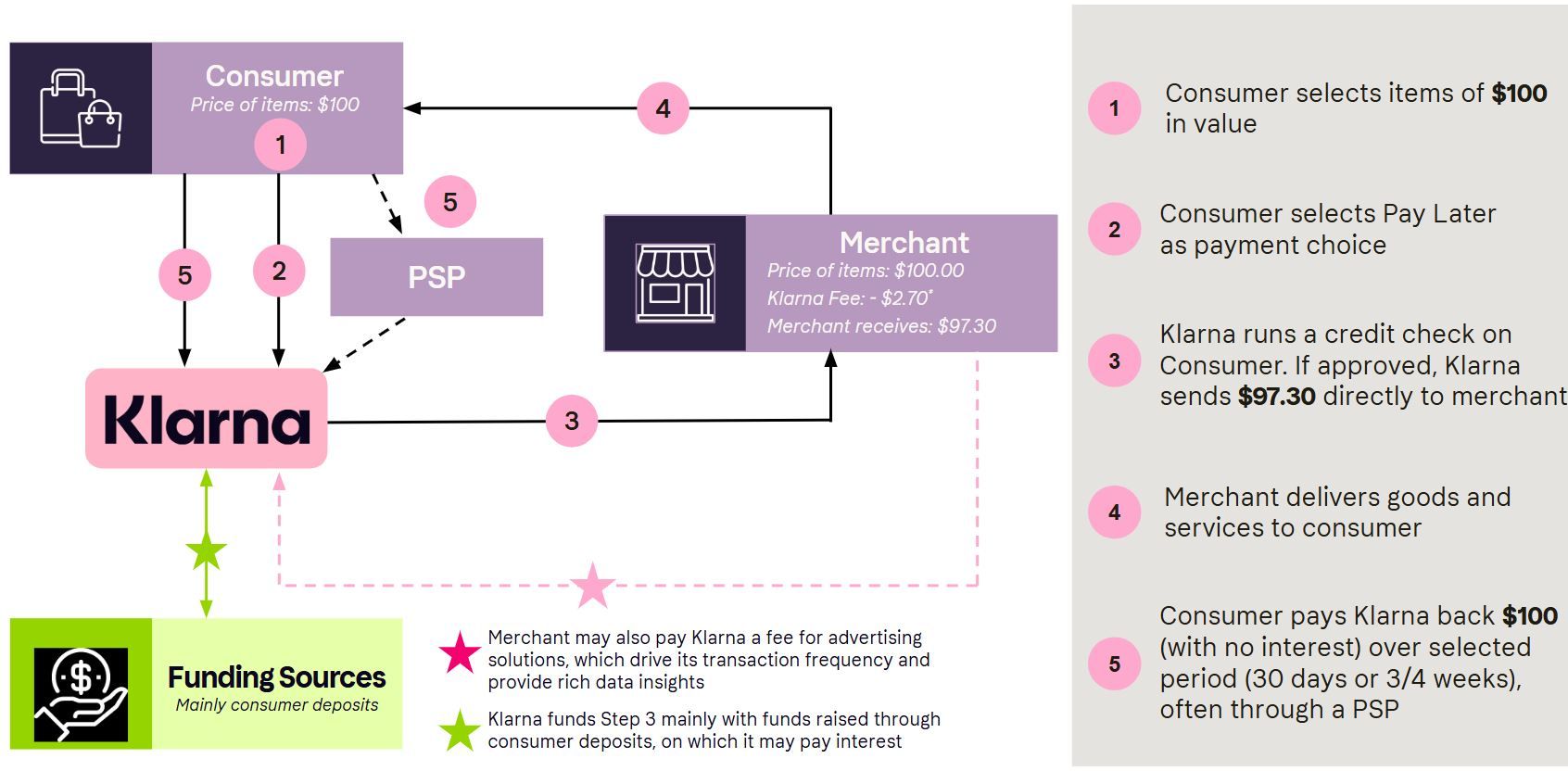

For merchants, this friction translates into lost sales at the last step. A shopper might abandon a cart because they can't afford the full purchase upfront or are deterred by a clunky payment form. Klarna was invented to solve these exact problems. Its founding vision was radical: to build a global commerce network where consumers have the flexibility to pay on their own terms, and merchants gain a powerful tool to boost sales and loyalty.

The company makes its money not by punishing consumers with debt but by providing a valuable service to merchants who, in turn, pay for the increased sales and customer engagement. This creates a powerful, self-reinforcing ecosystem where Klarna’s success is a direct result of helping others succeed.

Illustrative Pay Later Transaction, from S-1

Real-World Impact on Commerce

The success of this unique model is most vividly demonstrated by its transformative real-world impact. Klarna doesn't just process payments; it acts as a powerful growth engine for its partners. For merchants like Nike and H&M, Klarna has helped boost average order values and conversion rates. Case studies have shown that some of the top 100 global merchants using Klarna see a significant uplift in sales. The company's reach is staggering, with its network including major players like Uber and Airbnb.

Klarna's mission is to be the go-to partner for businesses seeking to modernize their checkout experience and attract a new generation of consumers. Its massive global network of over 150 million active consumers and 500,000 retail partners creates a powerful compounding effect, making it incredibly difficult for competitors to replicate.

The powerful impact on merchants is just as significant. As stated by Tom Dupont of ABOUT YOU, Klarna's payment solutions have been a "key driver" in offering a more personalized shopping experience and supporting their expansion across Europe. Similarly, Klarna's partnership with Expedia Group has been influential in attracting a "new generation of travelers" and has led to a doubling of transactions from new Klarna customers in the U.S. year-over-year, alongside an approximately 5% increase in basket size.

This success is not limited to one sector. In the beauty industry, Klarna's partnership with Sephora has helped increase customer satisfaction and drive growth, with Klarna users shopping at Sephora an average of 6.8 times per year, compared to 4 times for other Sephora customers. This demonstrates how Klarna's flexible and customer-centric solutions drive both customer acquisition and revenue growth, making it an essential partner for a wide range of businesses.

The Aspirational Paradox

At first glance, the idea of using a BNPL service to pay for a vacation might seem strange, even counterintuitive. After all, a trip isn't a pair of shoes that you need right now. However, this is precisely where Klarna's true value proposition shines: it transforms aspirational, big-ticket expenses from a burden into a manageable part of a financial plan.

Instead of waiting months to save the full amount, and potentially seeing flight or hotel prices increase, a traveler can lock in the best available rate today. By spreading the cost over a few weeks or months, they can avoid the high-interest credit card debt that often comes with such large purchases. This is a core part of Klarna's strategy: making life-enhancing experiences more accessible without sacrificing financial responsibility.

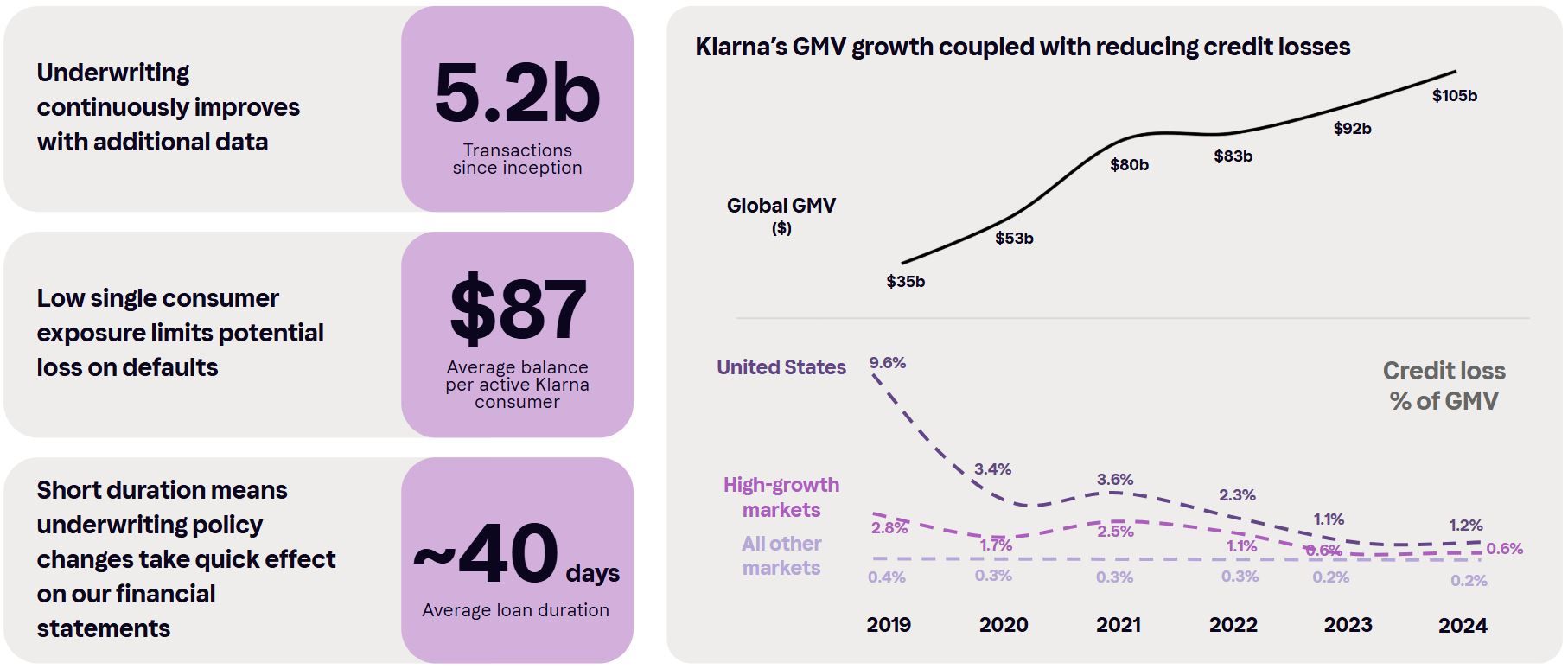

And while some think Klarna is contributing to worsening financial well-being for people, the data shows that borrowers are doing better than we think, as their credit losses have dwindled as a percentage of gross merchandise value (GMV).

GMV Growth Coupled with Reducing Credit Losses, from Klarna S-1

A Sustainable Future for Finance

Just as credit cards once fueled a new era of consumer spending and economic growth, Buy Now, Pay Later (BNPL) can create a similar, but more sustainable, economic boom. Credit cards democratized access to goods and services but often at the cost of high-interest debt that traps consumers in a vicious cycle.

Klarna’s BNPL model represents a radical evolution in personal finance. Instead of encouraging a "pay with future debt" mindset, it promotes a "pay responsibly" approach. By breaking down purchases into fixed, interest-free installments, Klarna empowers consumers to budget more effectively and manage their cash flow without the fear of accumulating high-cost debt.

This shift in mindset is a boon for everyone in the long run. It fosters greater financial literacy, builds healthier spending habits, and allows a wider segment of the population to access goods and services without predatory terms. This foundational change has the potential to unlock new economic opportunities and consumer confidence on a massive scale.

The Power of AI & Expansion

Klarna's enduring advantage is its pioneering use of AI. This isn't a company that just sprinkles AI on top of an old business model; it’s an AI-powered business at its core. Klarna’s proprietary data, derived from processing billions of transactions, feeds its sophisticated AI-driven underwriting engine.

This technology enables fully automated, real-time credit decisions that are more accurate and equitable than traditional methods. The power of this is clear in the numbers: Klarna's AI-powered assistant handles an astonishing two-thirds of customer service chats, doing the work of 700 full-time agents and saving the company millions in operational costs. This allows Klarna to scale its operations with incredible efficiency and significantly improve its average annual revenue per employee, which has increased from $344,000 to $821,000, demonstrating a highly optimized and automated business model.

Beyond its core BNPL offering, Klarna is expanding into two other massive, high-margin opportunities: payments and digital advertising. The company's S-1 filing highlights a $520 billion payments revenue opportunity, of which it currently only captures a small fraction. By moving beyond just BNPL to offer a full suite of payment options, including "pay in full" and digital wallets, Klarna is positioning itself to capture a larger share of global consumer spending.

This strategy is mirrored by other tech giants that have successfully leveraged their networks and user data to create new, profitable revenue streams. Companies like Uber, Lyft, and Instacart, for example, have all built massive-scale businesses on a core service and then expanded into a highly lucrative digital advertising model to reach profitability. Klarna is doing the same, using its massive network of intent-driven shoppers to provide targeted advertising for merchants. This allows it to generate revenue from both its payments processing and its advertising services, creating a powerful dual-monetization model that positions it for long-term financial success.

Klarna is also poised to capture an even larger part of the digital payments and advertising landscape. The global payments market represents an estimated $750 billion revenue opportunity, of which Klarna's 2023 GMV represented less than 0.5%. Similarly, the digital advertising market is a $475 billion opportunity, where Klarna's current revenue captures a mere 0.03%. The company believes it is well-positioned to grow faster than the broader market, driven by the secular trend of digital payments gaining share over credit cards.

Furthermore, Klarna is making a push into digital retail banking with products like "Klarna balance," which allows consumers to hold funds and manage their finances directly within the app, demonstrating an ambition to be a central hub for their users' daily financial lives.

Conclusion

In conclusion, Klarna's story is about more than just a new way to pay. It’s about building a better, fairer commerce network for everyone. By solving real-world problems for both consumers and merchants, fostering healthier personal finance habits, and leveraging cutting-edge AI to create a powerful and efficient business, Klarna is not just a compelling investment. It's a company reshaping the very foundation of the modern software economy.